all in-house

-

wealth management diversified for capital preservation with coverage of public, private & digital assets & alternatives

-

proprietary institutional grade portfolios, no indexed models

-

US to global services for individuals & entities covering strategic advice, filings, compliance, planning & formations

-

living trusts

advanced taxable estate

-

capital gains tax minimization strategies, transition & exit planning, & risk management

firm

-

20+ years of investment banking & institutional advisory experience

-

100% partner-owned fiduciary with no conflicts of interest, no products to sell, and no commissionable services

-

fee-only registered investment advisory with managed client assets held at goldman sachs

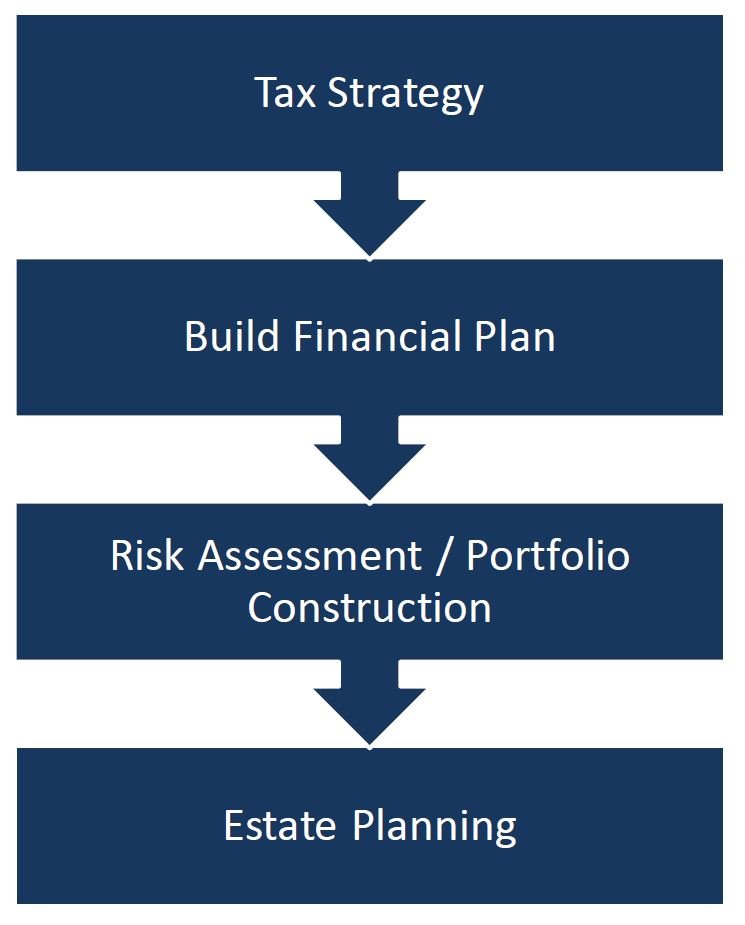

ANALOG IS process driven, objective & precise

core components of planning

tax strategy:

we specialize in tax efficient structure and tax minimization strategies

financial plan:

we will build bespoke financial plans and investment strategies to achieve your goals and build generational wealth

estate plan:

we create highly complex structures for high net worth clients to minimize capital gains and estate taxes in addition to simple living trusts

unconstrained investment advice across listed, private, digital, & alternative assets

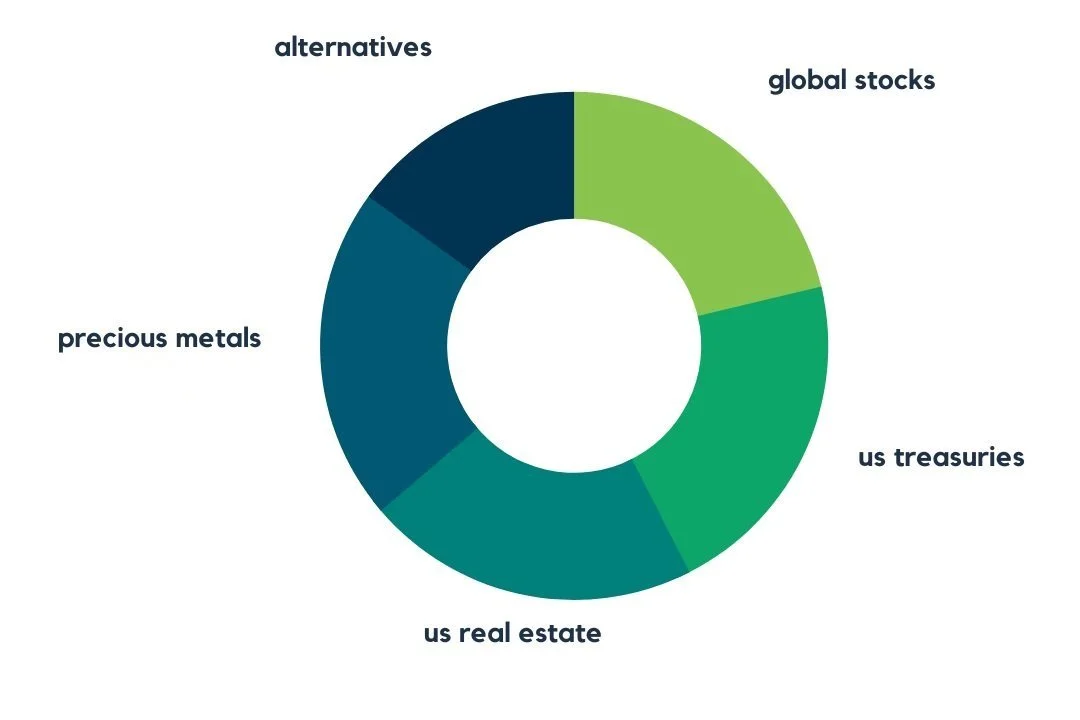

conserve & build wealth with managed diversity

our core portfolios are liquid, low-cost, uncommonly diverse and custodied at goldman sachs

they offer lower expected volatility and drawdown without sacrificing growth compared to typical advisor models:

evenly balanced asset mix (moderate)

gold & silver

us Real Estate Securities

us treasury bonds

high quality global stocks

no credit risk or mutual funds

low cost of ownership (20bps wtd avg expense ratio)

no transaction fees

liquid & marginable

advisory fee: 0.6-1.0% p.a.

tax,asset management, estate, & risk alignment elevates your plan strategy

strategic Planning

income replacement

wealth preservation

risk management

transaction and exit planning

investment advice

managed low volatility portfolios

stocks, bonds, real estate and precious metals

private market opportunities

alternative investments

investment due diligence

family office services

tax planning

liquidity & cash flow planning

trusts & estate planning

capital advisory

409a valuations

for the best results, consider planning early

early planning can make a huge impact on results later on

We love analog clients: nonconformist, gifted and irreverent value creators (>80% of our clients are founders)

we function as their end-to-end integrator across tax, finance, estate and legal services, meaning we manage multi-disciplinary planning from design through maintenance

our purpose is to streamline planning that maximizes and conserves value - often from corporate transactions or M&A

get help from experienced professionals

unconflicted advice

analog is a registered investment advisory firm serving founders (>80% of our clients) nationwide since 2020

our purpose is to integrate our own expertise with adjacent disciplines to maximize value realization and conservation

we stand apart through our values:

no conflicts of interest

no constraints

high transparency

we stand apart for the practices we embrace and disavow:

no mutual funds - stocks and ETFs only

no products to sell

no long-term credit risk

no account or transaction fees

truly diversified asset type coverage

collaborative with outside advisors and specialists

new investments deployed over time programmatically

if you’d like to speak with us, please feel welcome to arrange a call via the link: here

Alternatively, please submit your information below:

By submitting this form, you agree to receive recurring automated promotional and personalized marketing text messages. Consent is not a condition of purchase. Message frequency varies.

view our privacy policy here.

view our sms terms here.

You may opt out at any time.

To unsubscribe, text:

STOP

You may receive a confirmation message indicating that you have been opted out and will receive no further messages unless you re-opt in.

For help regarding the Program, text:

HELP

Or contact us directly at:

info@acpfo.com

(713) 929-2553